In an era of remote working, hiring an international team can make a lot of sense.

You have access to a much wider pool of talent, for one thing. And depending on which industry you’re in, it may be useful to have experts in different countries for the sake of your localization strategy.

But just how do you handle international payroll processes? In this article, we take a close look at some of the challenges you’ll face around salary payments when employing people across borders. We’ll also explore five best practice approaches to make sure you get it right every time.

Challenges of remote international payroll management

Some aspects of managing remote teams are fairly straightforward, like using videoconferencing for meetings or remote monitoring to keep an eye on tech equipment.

Unfortunately, managing payroll across borders is a bit more complex. Two of the crucial challenges you’ll need to tackle head-on are legal compliance and implementing payment transfers.

Legal compliance

Employment laws vary widely across the globe. If you’ve been operating in a single jurisdiction and you’re scaling up internationally, you may be surprised at how different other legal landscapes are.

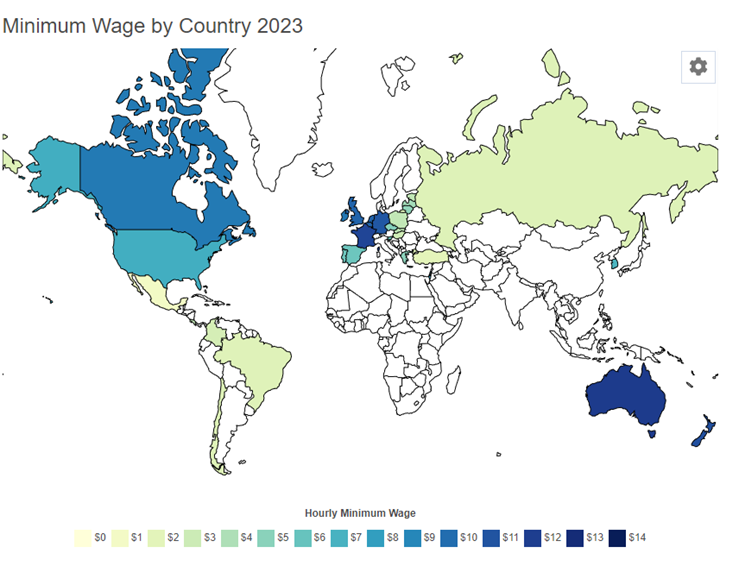

Minimum wage rates

Minimum wage rates can also change massively depending on the country.

If your business has been operating according to the federal US minimum wage of $7.25 per hour, you might be in for a surprise. The rates tend to be much higher in Canada, Australia, New Zealand, and many European countries. In France, for example, you’re looking at a minimum wage of €11.52 ($11.66) per hour as of May 2023.

It’s worth noting that there are also some slight variations in how minimum wage rates are calculated. For example, some countries like Sweden don’t have a minimum wage instead, they have minimum salaries arranged through a collective agreement.

Working hours caps

Similarly, there are laws in many countries capping the number of hours employees are legally allowed to work. In the EU, the maximum work hours per week is set at 48, with the following being included in that time:

- Time an employee is at the employer’s ‘disposal’ (when the employer can demand what they can and can’t do)

- Time carrying out normal work activities

- Time spent training

- Time spent on call

Time spent traveling to work is not generally included, nor are any rest breaks when there’s no work being done. In other words, you don’t need to count your employees’ lunch breaks, but you do need to count any time spent clocked in waiting for work.

As you can imagine, this can get very complicated when you’re managing remote teams. One useful approach is to implement enterprise resource planning (ERP) software to keep track. ERP systems typically have robust human resources management functionality, including time and attendance tracking.

This makes it pretty straightforward to configure your settings to monitor and enforce compliance with maximum working hour regulations. It also allows you to track time spent on projects without resorting to a more overbearing employee monitoring software.

Tax laws

Mandated or expected employee benefits

Benefits are a large consideration. In many parts of the world, you will be obliged to pay a substantial social security uplift. This may cover pension contributions, unemployment insurance, healthcare, parental leave payments, and so on.

Again, the requirements and expectations can vary significantly across different jurisdictions. For example, while there’s no federal requirement for companies to provide healthcare coverage for employees in the US, most offer some as standard. In the UK, on the other hand, it’s unusual for an employer to provide this.

Managing payments

There are a number of issues to consider when transferring payments:

Payment method compatibility: most countries are plugged into the SWIFT banking system. That makes it a straightforward solution for paying employees as long as they have a bank account with a participating bank. Otherwise, you may need to consider options like e-wallets like PayPal or money transfer services like Western Union.

Bank charges: if you do use SWIFT, you should be aware that there will be a charge of around $25 to $50 for every transfer you make. Other payment providers will also impose various charges, which can add considerably to the total bill.

Exchange rate volatility: if you have a large number of employees spread across multiple countries, fluctuations in the exchange rates of the local currencies to your home currency can become a problem. This is a difficult expense to budget for since it’s so unpredictable. Just make sure you allow some contingency for it in your planning.

Data security: your reputation will stand or fall depending on how tightly you maintain your data security. That said if you decide to transfer payments, make sure that your security is up to date and impenetrable.

5 best practice tips for managing the international payroll process

Let’s take a look now at some of the best approaches for dealing with remote payroll management for international teams. This list flags up a few elements of the process to be aware of and suggests some general solutions.

1) Error correction

No matter how well-planned your payroll procedures are, occasional mistakes are inevitable. So, you need to have a solid process in place to correct them quickly. If you don’t do this, you run the risk of multiple errors piling up. This could lead to employee frustration, and if you don’t get back on track quickly, you could begin to lose your best talent.

First, that means having a procedure for identifying and reporting mistakes. Then, clear guidelines on how these should be corrected, with a transparent line of responsibility for the process. Bear in mind that you are responsible for any errors that are made in payroll, so you can’t simply depend on employees to check their payments are accurate.

2) Absence management

Another important aspect of payroll is absence management. The complexity of managing widely differing legal obligations across jurisdictions can make this tricky. Legally mandated paid leave allowances can be as much as 30 days per year for a full-time worker in some territories, whereas others will be substantially less generous.

Note, too, that paid sickness leave allowances are very common as a separate legal right in addition to general paid leave. This means any payroll system you use has to take into account the fact that it may not be possible to cap total absences per time period.

As an added security tip, absence management tends to involve more personal and sensitive employee information. So it’s best to consider how your data is stored and whether you should use end-to-end encryption when sending information to prevent any harmful data breaches.

3) Integrate your operations

In general, the best way of managing all these diverse requirements is to make sure all of your business operations are seamlessly integrated. That means everything from your sales and HR processes to your distribution and customer support teams should have access to all of the necessary data.

The easiest solution to this is to keep all your business-critical information in a centralized repository. This may seem like quite a challenge for smaller organizations that lack the resources of large corporations.

Luckily, there are now ERP cloud platforms available that enable companies to do just that without having to commit a huge capital investment. These systems help you make sure all of your business processes are fully aligned, making it much easier to navigate the complex legal landscape around international payroll operations.

4) Payroll software

There’s also the option of using dedicated payroll software solutions. These calculate the correct amount of pay due and distribute it automatically. You’ll need to pay license fees, but it can be worth it to benefit from a ready-made solution. Having access to expert customer support is also a big plus.

If you go this route, make sure to select a platform that caters for international payments. These tools are specifically designed for simplifying payroll tasks across borders, so they have plenty of relevant built-in functionality.

5) Outsourcing

There are two main methods of outsourcing the whole payroll procedure: either via a payroll service provider or by using an Employer of Record (EoR).

Payroll service provider

Third-party payroll service providers specialize in managing payroll processes for clients. They handle tasks like employee payment transfers, record keeping, and tax management.

The great thing about opting for an international payroll service provider is that there’s no need for you to keep up to date on the hugely diverse array of global payroll policies and regulations. Instead, this becomes the provider’s responsibility.

They’ll need access to your employee data, of course. Reputable providers will enable secure remote access, so you don’t need to have any concerns about data security.

Employer of Record

Alternatively, you can use an EoR. These are third-party companies within the jurisdictions you wish to operate in. The idea is that you hire your employees through these companies. Technically, this means your employees are on the EoR’s payroll, even though they work for you. The EoR takes care of all of the legal payment and tax obligations, so you don’t have to.

Remember that there will still be operational elements you’ll have to implement yourself. For example, hiring an EoR won’t help you evade minimum wage laws or working hours regulations. But from the point of view of calculating and distributing payments, it’s a neat solution.